Invoiless Accounting Tools are designed to simplify and streamline financial management, especially for small business owners, freelancers, and entrepreneurs. Managing finances can often feel overwhelming, particularly when you don’t have a background in accounting. Traditional accounting methods are time-consuming and prone to errors, which can negatively impact your business’s financial health.

Invoiless Accounting Tools provide an efficient solution to these challenges. They automate tasks like invoicing, expense tracking, tax calculations, and reporting, making it easier to manage your finances.

But are these tools genuinely effective? In this review, we’ll explore the features, benefits, and potential drawbacks of Invoiless Accounting Tools to help you decide if they’re the right choice for your business or if traditional financial management methods might still be a better fit.

What Are Invoiless Accounting Tools?

Invoiless Accounting Tools are software solutions that streamline accounting tasks. They help small businesses and freelancers manage their finances by automating processes like invoicing, expense tracking, tax calculations, and reporting. These tools are designed to remove the complexity of accounting and give users a clear overview of their financial situation.

Unlike traditional accounting systems, which require extensive manual input and expert knowledge, Invoiless tools offer user-friendly interfaces and automation, making them accessible even to those with minimal accounting experience.

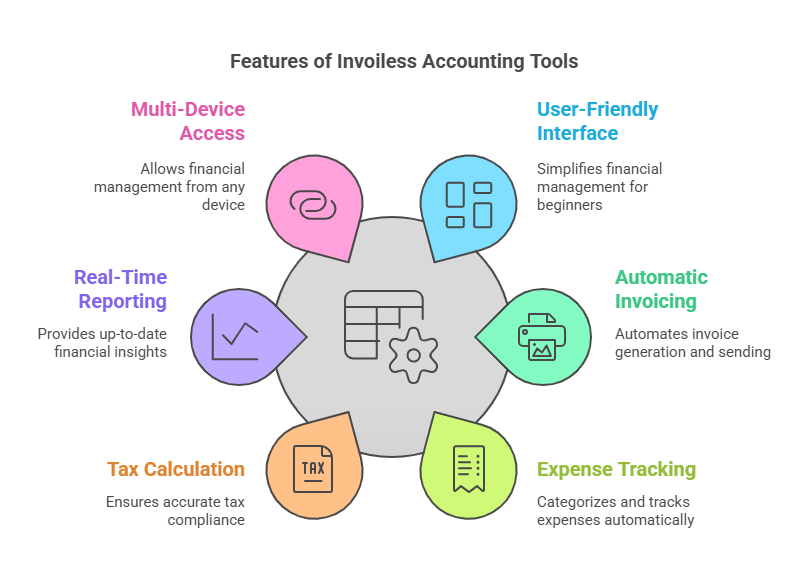

Key Features of Invoiless Accounting Tools

1. User-Friendly Interface

One of the most significant benefits of Invoiless Accounting Tools is their simplicity. These tools are designed for beginners, so you don’t need to be an accounting expert to use them effectively. The clean, intuitive interfaces guide users through every step of the financial management process. These tools make it easy to create an invoice, track expenses, or prepare a report.

2. Automatic Invoicing

Creating invoices can be tedious, but Invoiless Accounting Tools eliminate this burden. You can generate invoices automatically based on your products or services. Recurring invoices can also be set up, so if you have clients who need to be billed regularly, the tool will send invoices at the appropriate intervals.

3. Expense Tracking

Managing expenses is a critical part of running a business, but keeping track of every purchase can be challenging. Invoiless tools help by categorizing and tracking your expenses automatically. By connecting your bank accounts and credit cards to the software, all your transactions can be imported and categorized, making it easy to monitor your spending.

4. Tax Calculation

One of the most stressful aspects of accounting is preparing for tax season. Invoiless Accounting Tools automatically calculate the taxes you owe based on your income and expenses. These tools ensure that you are always compliant with tax laws and help you avoid costly mistakes that could result in penalties or audits.

5. Real-Time Financial Reporting

Knowing your business’s financial health is crucial to making informed decisions. Invoiless tools provide real-time financial reports, including profit and loss statements, balance sheets, and cash flow reports. These reports are updated automatically, giving you an up-to-date view of your finances whenever needed.

6. Multi-Device Access

Many Invoiless Accounting Tools offer cloud-based solutions, allowing you to access your data anywhere. Whether at home, in the office, or on the go, you can manage your finances from any device with internet access. This makes it easier to keep track of your financials no matter where you are.

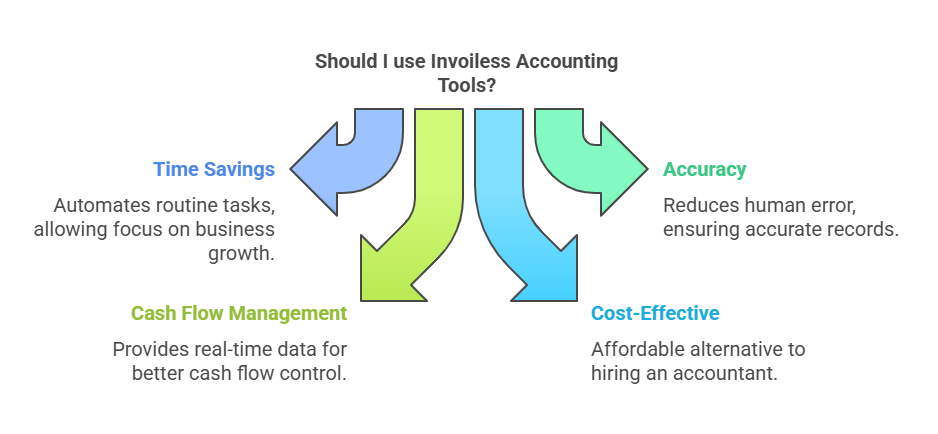

Benefits of Invoiless Accounting Tools

1. Time-Saving Automation

Invoiless tools save you time by automating routine accounting tasks such as invoicing, tax calculation, and expense tracking. With fewer manual tasks, you can focus on growing your business, serving your clients, and handling other important tasks.

2. Accuracy and Reduced Errors

Manual accounting is prone to mistakes, especially when dealing with complex calculations or large volumes of data. Invoiless tools reduce the risk of human error. The software automatically updates and calculates everything, ensuring your records are accurate and current.

3. Improved Cash Flow Management

Cash flow is the lifeblood of any business. Invoiless tools help you manage cash flow more effectively by providing real-time data about outstanding invoices, incoming payments, and overdue bills. This lets you follow up on late payments and better manage your working capital.

4. Affordable Solution for Small Businesses

Hiring an accountant can be expensive, especially for small businesses. Invoiless Accounting Tools provide a more affordable alternative. These tools typically have lower monthly fees than hiring a professional accountant or using traditional accounting services. With a one-time setup cost or affordable subscription, you can access many features without breaking the bank.

5. Tax Compliance

Staying compliant with tax regulations is crucial to avoid fines and penalties. Invoiless tools automatically calculate and generate tax reports, helping you stay current with your tax obligations. This feature is handy for business owners unfamiliar with tax laws and regulations.

6. Customizable Reports

Invoiless Accounting Tools allow you to customize reports based on your business needs. You can filter reports by date, category, or client, giving you a clearer view of your finances. This flexibility helps you make data-driven decisions that can improve your business’s financial health.

Who Should Use Invoiless Accounting Tools?

Invoiless Accounting Tools are ideal for small business owners, freelancers, and entrepreneurs who want to simplify their financial management. If you are a sole proprietor, freelancer, or run a small team, these tools can help you keep your finances organized without accounting knowledge. They also benefit anyone who wants to reduce the time spent on manual accounting tasks and focus on more critical aspects of their business.

Drawbacks of Invoiless Accounting Tools

1. Limited Features for Larger Businesses

While Invoiless Accounting Tools work well for small businesses, they may not offer all the features larger organizations require. Businesses with complex financial needs, such as multi-currency transactions, payroll management, or advanced economic analysis, may lack these tools in certain areas.

2. Dependence on Internet Access

Most Invoiless tools are cloud-based, so you need a stable internet connection to access your financial data. If your internet connection is slow or unavailable, you may be unable to access your accounting information.

3. Learning Curve

Although Invoiless tools are designed to be user-friendly, beginners may still find it difficult to learn. Getting familiar with features such as tax calculations or generating custom reports may take some time. However, most tools provide tutorials and customer support to help users get up to speed.

4. Data Security Risks

Cloud-based tools are convenient, but they also come with potential security risks. Choosing a reputable tool that implements strong security measures, such as encryption and two-factor authentication, is essential to protect your financial data from unauthorized access.

How to Choose the Right Invoiless Accounting Tool

1. Understand Your Business Needs

The first step in choosing an Invoiless Accounting Tool is understanding your business needs. If you’re a freelancer, a basic invoicing tool might be enough. But if you run a small business with multiple clients and employees, you’ll need a tool that can handle more complex tasks like payroll and financial reporting.

2. Check for Integrations

Many Invoiless tools integrate with other business software, such as payment processors, project management tools, and CRM systems. Ensure that the tool you choose integrates with the software you already use, so you don’t have to manage everything separately.

3. Customer Support

Make sure the tool offers reliable customer support. Whether you need help setting up the tool or troubleshooting an issue, responsive customer support can make a big difference in your experience.

Invoiless Accounting Tools vs. Traditional Accounting

Invoiless Accounting Tools are an alternative to traditional accounting methods. While traditional methods require manual bookkeeping, calculations, and reporting, Invoiless tools automate many of these processes, saving you time and reducing the chances of errors. Traditional accounting methods are also more expensive since they often require hiring professionals. In contrast, Invoiless tools offer affordable pricing plans that cater to small businesses.

Frequently Asked Questions (FAQs)

1. What is Invoiless Accounting?

Invoiless Accounting refers to automated accounting tools designed to simplify the financial management process for small businesses. They handle tasks like invoicing, expense tracking, tax calculations, and reporting.

2. Are Invoiless Accounting Tools secure?

Yes, reputable Invoiless tools use strong encryption and security measures to protect your financial data.

3. Do Invoiless tools provide tax calculations?

Yes, most Invoiless Accounting Tools automatically calculate taxes based on your income and expenses.

4. Can I use Invoiless Accounting Tools on multiple devices?

Yes, most Invoiless tools offer cloud-based solutions that allow you to access your financial data from any device with internet access.

5. Are Invoiless tools suitable for large businesses?

Invoiless tools are ideal for small businesses and freelancers. Larger businesses with more complex accounting needs may require more advanced software.

Simplifying Your Finances with Invoiless Tools

Invoiless Accounting Tools offer a straightforward, automated way to manage your business finances. Whether you are a freelancer or a small business owner, these tools can help you save time, reduce errors, and stay on top of your financial obligations. By automating key tasks like invoicing, tax calculation, and expense tracking, these tools simplify accounting, allowing you to focus on what matters most – growing your business.

These tools are not perfect for larger organizations, but for small businesses,