In the ever-evolving world of personal and business finance, finding the right tools to manage your finances efficiently is key. Financial Fusion Lifetime Deals are offers that allow users to access valuable financial software or services for a one-time payment, with no recurring subscription fees. These deals typically include financial management tools, investment trackers, and budgeting apps that help users optimize their financial management. By investing in a lifetime deal, you get full access to a service without worrying about monthly or annual renewals, making it a great option for long-term savings and convenience.

How Do Financial Fusion Lifetime Deals Work?

A lifetime deal allows you to pay a one-time fee to gain permanent access to a financial tool or platform. You don’t have to pay recurring fees, which makes these deals very attractive for users who want long-term access to financial services without worrying about subscription renewals. These tools can help with everything from budgeting and expense tracking to investment management and financial planning. Essentially, you’re paying upfront for lifetime access, which can save you significant amounts of money compared to paying for a monthly or yearly subscription.

The beauty of these deals is the simplicity they offer. There’s no hidden cost or surprise fee. Once you make the purchase, you own the software forever, which is ideal for individuals or businesses seeking reliable, cost-effective solutions to manage their finances.

Why Should You Consider Financial Fusion Lifetime Deals?

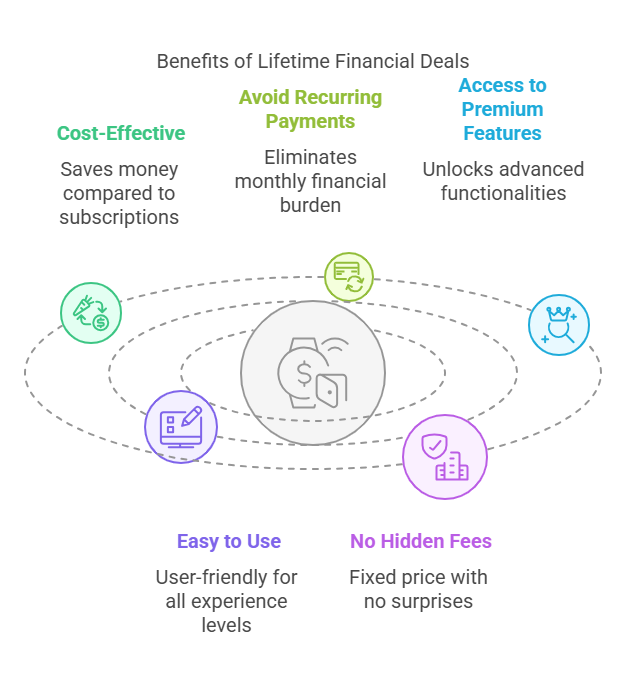

Here are a few compelling reasons why you might want to consider jumping on a financial fusion lifetime deal:

- Cost-Effective: Instead of paying monthly or annual fees, you pay once and get access for life. Over time, this can add up to significant savings.

- Avoid Recurring Payments: Monthly subscriptions can become a burden, especially when the financial tool is essential for daily use. With a lifetime deal, you don’t have to worry about ongoing payments.

- Access to Premium Features: Many financial tools offer premium features that can be unlocked through lifetime deals. This provides more advanced functionalities that help you stay ahead of the game.

- Easy to Use: Most financial fusion tools are designed to be user-friendly, catering to both beginners and experienced users. Whether it’s expense tracking or investment monitoring, the tools are easy to navigate.

- No Hidden Fees: With lifetime deals, the price is fixed, so there are no hidden charges or surprises later on.

How to Find the Best Financial Fusion Lifetime Deals

The first step to finding the best lifetime deal is research. Some many websites and platforms specialize in offering lifetime deals for digital products, including financial tools. Some of the most popular websites that offer these kinds of deals include AppSumo, StackSocial, and Dealify. These platforms typically feature lifetime deals for a range of services, including financial management tools, investment software, and financial planning platforms.

When searching for a deal, pay attention to the following factors:

- Reviews and Ratings: Check out what other users have said about the product. Are they satisfied with the features and customer support?

- Company Reputation: Ensure that the company offering the lifetime deal has a good reputation. A trusted company will be more likely to continue supporting the product.

- Features: Make sure the tool offers all the features you need. Some lifetime deals might only include basic features, so be sure to check if the advanced features are part of the deal.

- Customer Support: Check if the platform offers good customer service. This is essential in case you run into any issues with the software.

Benefits of Financial Fusion Lifetime Deals for Personal Use

For individuals, financial fusion lifetime deals offer several advantages. Whether you’re a freelancer, a student, or someone looking to manage your finances, a lifetime deal can help simplify the process:

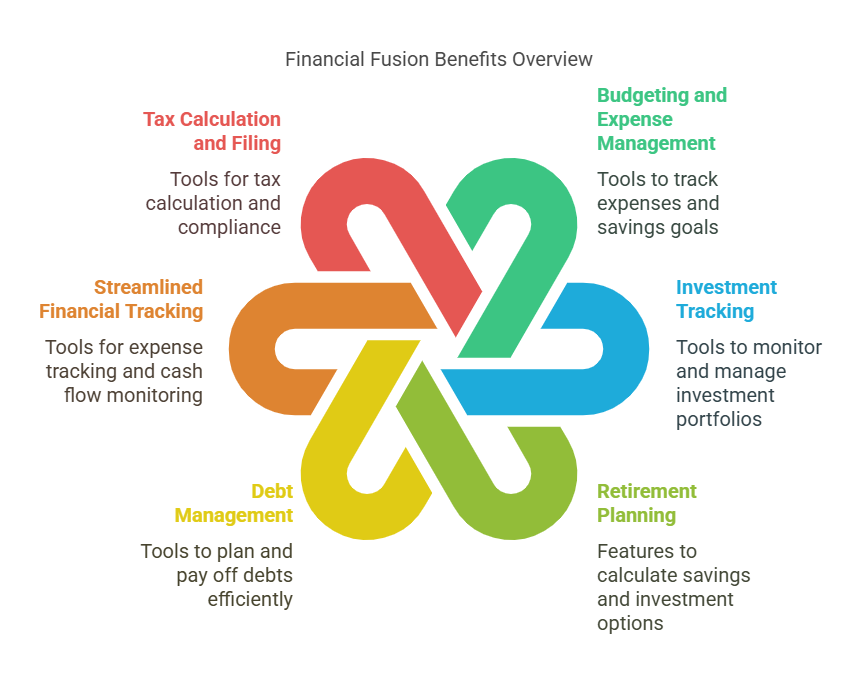

- Budgeting and Expense Management: Many lifetime deals feature budgeting apps that allow you to track your daily expenses and manage your savings goals. This can be crucial in helping you maintain a balanced financial life.

- Investment Tracking: As the world of investments becomes more complex, tools that track your portfolio can help you make informed decisions. With a lifetime deal, you can monitor your investments without worrying about ongoing subscription fees.

- Retirement Planning: Long-term financial planning is essential for anyone looking to secure their future. Tools that offer retirement planning features can help you calculate how much to save and suggest the best investment options.

- Debt Management: Some tools come with debt management features, helping you to plan and pay off loans, credit cards, and mortgages more efficiently.

Benefits of Financial Fusion Lifetime Deals for Businesses

If you run a business, a financial fusion tool can help you manage everything from payroll to expenses, taxes, and investments. Here are some key benefits for businesses:

- Streamlined Financial Tracking: With a lifetime deal, your business gets access to tools that can track daily expenses, automate invoicing, and monitor cash flow without the hassle of ongoing payments.

- Tax Calculation and Filing: Many financial tools help calculate taxes for businesses, ensuring that you stay compliant with government regulations. You can also use these tools to file taxes directly or create reports for your accountant.

- Financial Forecasting: Financial forecasting is essential for businesses that want to stay on top of their finances. A reliable tool can help you predict future earnings, expenses, and investments, which is vital for making data-driven decisions.

- Multi-User Access: Some financial tools offer multi-user access, allowing team members to access and manage financial data securely. This can be particularly useful for small businesses and startups.

Financial Fusion Lifetime Deals vs. Monthly Subscriptions

A key consideration when choosing between a lifetime deal and a subscription is the long-term cost. With monthly subscriptions, the cost might seem manageable at first, but over time, you could end up paying more than the cost of a lifetime deal. Here’s a quick comparison:

- Lifetime Deal: Pay once and get full access for life.

- Monthly Subscription: Pay every month or year, and you continue paying indefinitely.

In the long run, lifetime deals often prove to be the more cost-effective option. However, if you’re unsure whether the product fits your needs, a monthly subscription might be a safer choice.

How to Ensure You’re Getting a Good Financial Fusion Lifetime Deal

Not all lifetime deals are created equal. Here’s what to look out for to ensure that you’re getting value for money:

- Quality of Features: Look at the features that come with the deal. A great lifetime deal should include robust, high-quality tools that will meet your needs over time.

- Customer Support: A reputable company offering a lifetime deal should also provide reliable customer service. Make sure you can contact them if you have any issues.

- Security: Ensure that the financial tool you’re purchasing has robust security features to protect your sensitive data. This is especially important for businesses and investors.

- Future Updates: Some deals include lifetime access to updates, which can be a big bonus if the company continues to improve the software over time.

Frequently Asked Questions (FAQs)

- What does “lifetime deal” mean?

A lifetime deal means that you pay a one-time fee for access to a product or service for life. There are no ongoing subscription fees. - Are lifetime deals safe to purchase?

Yes, as long as you buy from reputable platforms. Always research the product and company before purchasing. - Can I get a refund for a lifetime deal?

Refund policies vary. Check the terms and conditions before purchasing to see if refunds are offered. - How do I know if the tool will be valuable for me?

Research the features, read reviews from other users, and compare the price with similar products. - Can businesses benefit from financial fusion lifetime deals?

Absolutely! Businesses can use these tools for expense tracking, payroll management, tax filing, and financial forecasting.