In the world of business, accounting plays a crucial role in ensuring smooth financial management. With the rise of online tools, managing finances has never been easier. One such tool that has caught the attention of business owners is Financial Fusion Accounting Tools.

But are these tools worth it? In this Financial Fusion Accounting Tools Review, we will dive into their features, benefits, and what makes them stand out in the crowded market of accounting software.

What is Financial Fusion Accounting Tools?

Financial Fusion is a suite of accounting tools designed to simplify the complex world of finance and accounting. It offers a range of features that help businesses track expenses, generate invoices, manage payroll, and more. These tools aim to provide a seamless accounting experience for small and medium-sized businesses.

Whether you are a startup or an established company, Financial Fusion promises to streamline your accounting processes, saving both time and money.

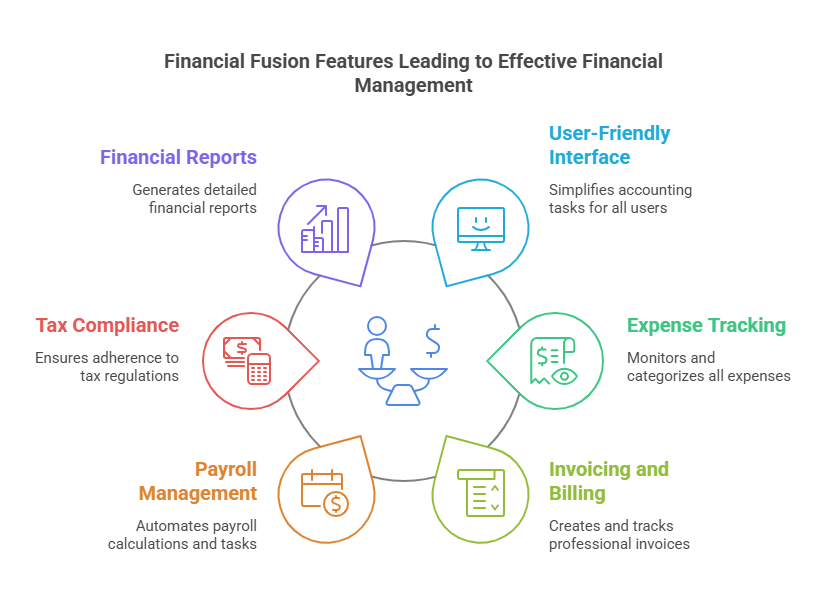

Key Features of Financial Fusion Accounting Tools

1. User-Friendly Interface

Financial Fusion makes it easy for users to manage their accounting tasks. The simple and intuitive interface allows even those with limited accounting knowledge to use the platform effectively.

You don’t need to be an accountant to understand your finances. The tool provides a dashboard where you can quickly access reports, and check your income, expenses, and balance sheets.

2. Expense Tracking

One of the most significant features is expense tracking. It allows users to categorize and track every expense incurred. Whether it’s a small purchase or a large transaction, you can monitor how your money is spent. This helps businesses make more informed decisions on their spending and budgeting.

3. Invoicing and Billing

Financial Fusion allows you to generate invoices directly from the platform. With this feature, you can create professional-looking invoices in just a few clicks. You can also track payments, which ensures you don’t miss out on any overdue invoices.

4. Payroll Management

Managing payroll can be a daunting task for businesses. Financial Fusion simplifies this by automating the payroll process. You can easily calculate employee salaries, and tax deductions, and manage employee benefits with just a few clicks. This feature saves time and reduces human error in payroll calculations.

5. Tax Compliance

Financial Fusion helps businesses stay compliant with tax regulations by providing accurate tax calculations. The tool is updated regularly with the latest tax rates, ensuring that your business complies with the laws of your region. This feature is especially useful for businesses that operate in multiple regions with different tax rules.

6. Financial Reports

Generating reports is an essential part of accounting, and Financial Fusion makes it simple. The platform offers comprehensive financial reports such as profit and loss statements, balance sheets, and cash flow reports. These reports give you a clear picture of your financial health.

7. Cloud-Based Access

Another standout feature is its cloud-based design. This means you can access your financial data from anywhere, at any time. You don’t have to worry about losing data or being tied to a specific location to manage your accounts.

Benefits of Using Financial Fusion Accounting Tools

1. Saves Time

By automating tedious tasks like payroll, invoicing, and expense tracking, Financial Fusion significantly reduces the amount of time you need to spend on accounting. This allows business owners to focus more on growing their business rather than getting caught up in numbers.

2. Increases Accuracy

Manual accounting is prone to errors. Financial Fusion ensures that all calculations are accurate, reducing the risk of human error. The software’s built-in features also alert users if there are discrepancies in the records, further reducing the likelihood of mistakes.

3. Improves Financial Insights

Financial Fusion provides users with in-depth financial reports that give a clear picture of where their business stands financially. These insights are crucial in making informed decisions, whether it’s adjusting your pricing strategy, cutting unnecessary expenses, or managing cash flow more effectively.

4. Easy to Use

You don’t need to be an accounting expert to use Financial Fusion. Its user-friendly interface ensures that anyone, regardless of their accounting knowledge, can use it. With easy navigation and automated features, it becomes easy to keep track of finances.

5. Scalable for Growing Businesses

As your business grows, so do your accounting needs. Financial Fusion is designed to scale with your business. Whether you have a small team or a large workforce, it can handle the increasing volume of transactions and payroll, making it a great long-term investment.

Is Financial Fusion Right for Your Business?

Financial Fusion is particularly beneficial for small and medium-sized businesses that are looking to simplify their accounting processes. If you’re a business owner who prefers to spend more time on core activities and less on managing your finances, then Financial Fusion might be the perfect solution for you.

However, it may not be suitable for large enterprises with complex accounting needs, as it may lack the advanced features required by bigger companies.

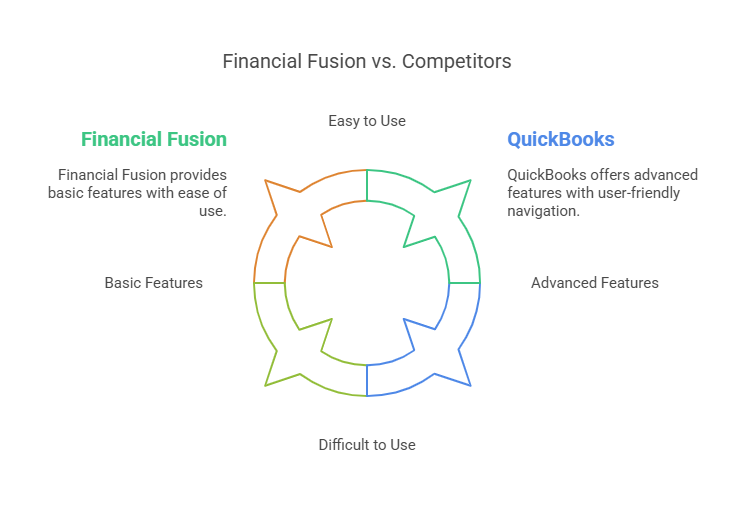

Financial Fusion Accounting Tools vs. Competitors

When comparing Financial Fusion Accounting Tools with other popular accounting software like QuickBooks or Xero, here’s how they stack up:

- Ease of Use: Financial Fusion is more beginner-friendly, making it an excellent choice for businesses that don’t want to deal with a steep learning curve.

- Price: Financial Fusion offers competitive pricing, making it a budget-friendly choice for small businesses.

- Features: While Financial Fusion offers all the basic features needed for small business accounting, it may lack some advanced features found in tools like QuickBooks.

Frequently Asked Questions (FAQs)

1. What is the pricing for Financial Fusion Accounting Tools?

Financial Fusion offers a range of pricing plans depending on your business needs. Plans typically start from a low monthly fee and scale up as additional features or users are added. You can visit their official website for detailed pricing information.

2. Is Financial Fusion cloud-based?

Yes, Financial Fusion is cloud-based, allowing you to access your financial data from anywhere at any time.

3. Can Financial Fusion handle taxes automatically?

Yes, Financial Fusion automatically calculates taxes based on the current tax rates for your region, helping you stay compliant with tax laws.

4. Is Financial Fusion suitable for large enterprises?

Financial Fusion is primarily designed for small and medium-sized businesses. Larger enterprises with more complex needs might want to consider other solutions that offer more advanced features.

5. Can I integrate Financial Fusion with other software?

Yes, Financial Fusion can integrate with various other software and tools, such as payment gateways and CRM systems, to help streamline your business operations.

After a thorough review, Financial Fusion Accounting Tools proves to be an excellent choice for small to medium-sized businesses. Its user-friendly interface, automatic payroll management, tax compliance features, and cloud-based accessibility make it a powerful tool for managing your finances efficiently.

If you are looking to simplify your accounting tasks and gain better financial insights without the need for an accounting background, Financial Fusion could be the right tool for you.